Why should high net worth individuals and families care about covered calls options strategy? (Also known as writing covered calls). It is because a covered call can be one way of increasing your potential income stream from the underlying stocks in your portfolio. Of course, given the value of HNW investor time, it is very likely a broker or a financial advisor suggests, writes, and monitors the covered call option strategy.

However, to become a savvy investor, it is essential to the basics of Covered calls, how they work, why and when they are useful, and of course the risks.

Let’s get one thing straight. While derivative instruments like CDS (Credit Default Swaps), which Warren Buffet equated with weapons of mass financial destruction, are complex, different, and deal typically with non-market instruments, many options strategies are an integral part of optimal portfolio management.

Covered Calls Options Strategy: Basic Overview

What are Covered Calls?

Here is a simple definition of a covered call with a brief explanation of each of the terms.

A covered call involves an investor selling the option on a stock for a fixed premium to someone else to buy a security that he/she owns at a pre-determined strike price with a set expiration date.

There is a lot of nuance in that statement. Let’s delve a bit deeper into it.

For a Call Option to become a “Covered Call,” you need to own the underlying stock. So, investors generally write covered calls on a security that is already in their portfolio. (There is a concept called “Naked options” and we will deal with that concept separately.)

Strike Price is the price at which the investor selling the covered call is obligated to sell the security. Typically, this is higher than the current price of the stock. So for example, if a security is currently trading at $100 and the owner sells a covered call at $120, the latter is called the strike price.

The expiration date is an essential concept as options are typically short-term contracts. (There are concepts like LEAPS (Long-term Equity Anticipation Securities) which again is a topic for a separate article.

Premium is the amount of the money the buyer of the call option is willing to pay for the right to buy a security at a certain price before a specified period. The premium is the money the seller of the covered call pockets.

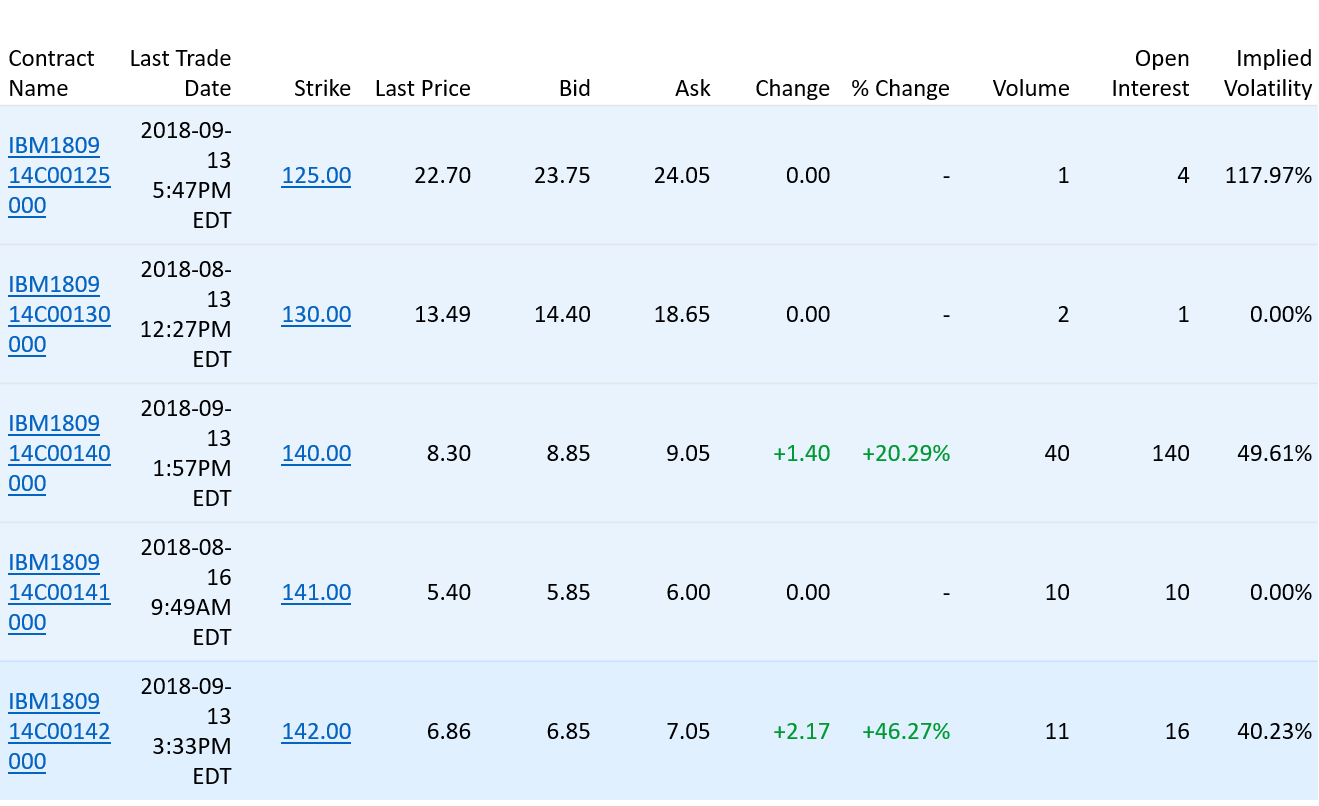

The following is a sample list of IBM options chain (courtesy of Finance.Yahoo.com)

Simple Example of a Covered Call:

Mary owns Stock A in her portfolio. She brought it at $20, and the current price of the stock is $50. Mary is happy with how well the stock has done and is OK to sell if necessary. So, instead of having this stock sit in her portfolio, Mary is interested in generating some income. She sells a covered call at a strike price of $60 for a premium of $1 per stock. She sells covered call options on 1000 shares and pockets the premium. In essence, the covered call is for a strike price of $60 on a stock that is currently valued at $50 for a premium of $1 expiring in 48 days.

“A covered call involves an investor selling the option on a stock for a fixed premium to someone else to buy a security that he/she owns at a pre-determined strike price with a set expiration date.”

Scenario 1: Between now and the expiration of the covered call option contract, the buyer, let’s call him Dennis, can claim the underlying security if the stock price is at or above $60. If the stock price is lower than $60 on the expiration date, the option expires, and Mary gets to keep the premium, thus generating an income of $1 per share on a stock that she already owns.

Let us assume that the stock price never went high up and was hovering at $55 per share. Mary can keep the premium, and she can rinse and repeat the same strategy for a higher strike price.

Scenario 2: Let us assume that the stock price on or before the expiration of the options contract is $72, then Dennis will exercise his option and buy the stock at $60. So, Mary will get to keep the premium ($1 per share) and the exercise price, which is $60. This scenario means Mary relinquished her ownership at $60, even though the cost of the stock was at $72. In essence, she made a premium of $1 per share plus $10 (the difference between the price of the stock on the day she sold the covered call option and the strike price) making a total of $11.

Scenario 3: This is the worst-case scenario. Instead of going up, after Mary wrote the covered call option, the stock price dropped, and the expiration is still weeks away. Mary does not sell the underlying stock due to the concern that the stock may up and be assigned. By then, the stock which was at $50 the day she should the covered call, drops to $42. While Mary made the $1 premium per share, she lost $7 overall per share. (Obviously, she could also buy back the option and cost/loss will depend on the then premium.)

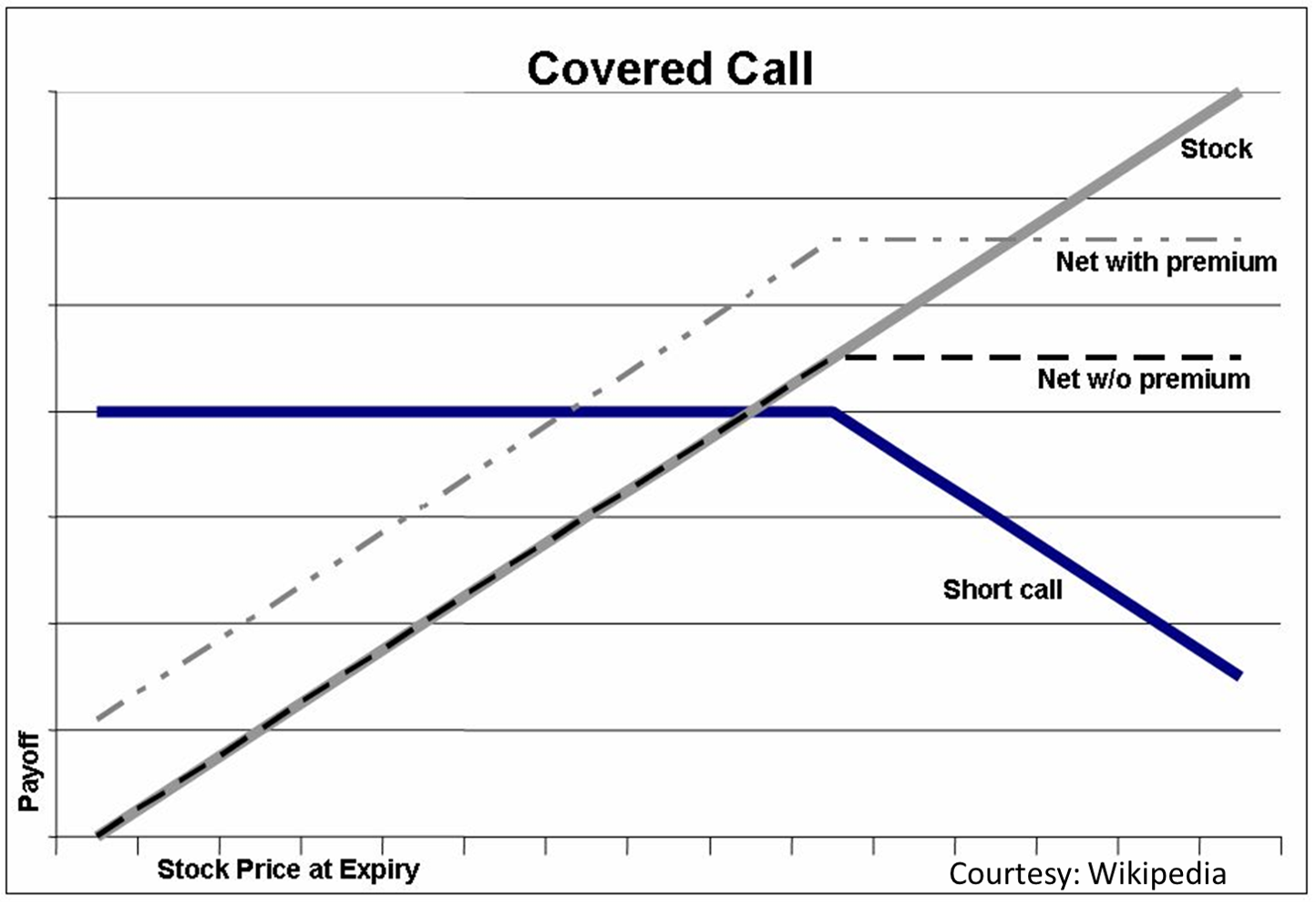

Covered Calls Options Strategy Sample Diagram: (Courtesy – Wikipedia)

What are the benefits of covered call options?

When optimally executed, a covered call option strategy may boost portfolio income.

When an investor has attained the desired price level, a covered call affords a way to generate some additional return.

Risks of Covered call options:

The most significant risk is the stock dropping significantly. For example, an investor is willing to sell at $50 but because of greed thought to wait until $60 and has written covered calls at a strike price of $60. But as outlined in the scenario 3, if the stock drops to $40, she will have a significant loss in her holding (assuming she does not want to hold naked calls).

Another risk is the potential opportunity cost. When holding the security, for a premium of $1, the investor may have lost the opportunity to sell at a market price in the future which may be higher than the strike price at which the investor is obligated to sell.

Frequently Asked Questions about Covered Calls Options Strategy:

How should HNW investors leverage Covered Calls Options Strategy:

For investors with significant holdings in specific stocks in which they have a neutral to slightly bullish stance, a covered call strategy may make sense. Selling covered calls and the receiving the premium boosts portfolio income instead of a passive approach. Secondly, HNW investors sometimes use the premiums collected by selling covered calls to buy protection on their more volatile holdings then, thus offsetting some of the cost and protecting the downside.

What is the maximum profit you can generate?

For an investor selling the covered call, the maximum potential profit is limited to the strike price of the option minus the current stock price and add in the premium they received for selling the call option.

What is the maximum loss you can make with a covered call?

An investor can sell the underlying stock or close out the call option at any point in time. So the loss is anywhere from the current stock price to the level where the investor either closes out the option or sells the underlying stock exposing themselves to holding a naked option.

What are the ideal conditions for a covered call strategy to work well?

When the outlook is neutral to bullish for a specific stock and the overall market is marginally positive, and the trading is range bound represent the best conditions for covered call strategy to be viable and valuable.

Who issues the options?

Contrary to some believing, it is NOT the companies but the CBOE (Chicago Board of Options Exchange) that issues the options on exchange-listed stocks.

How can one nullify a covered call position?

If you do not want the obligation to sell the stock at the pre-determined option strike price, you can purchase back the option contract. The price may vary based on several factors including the underlying cost of the stock, the implied volatility, and the expiration.

How is the option price (premium) calculated?

Calculating the option price (or the premium) is a complex calculation. The options price depends on the underlying stock price compared to the strike price (the intrinsic value), the time left until option expiration (time value), and the volatility or price fluctuation of the underlying stock (volatility).

Industry experts and savvy investors use the Black Scholes Model to calculate option pricing.

Will a covered call strategy mitigate downside risk?

No. Not really. Except for the premium received while selling the covered call option contract, a covered call does not protect from the stock going to zero.

How are gains from Option premiums taxed?

Premium gains from covered call options are taxed as short-term capital gains.

Who regulates the options industry?

The SEC (Securities and Exchange Commission) governs the options contracts on listed securities. FINRA (Financial Industry Regulatory Authority) is a self-regulatory organization (SRO).

Note: This article on Covered call strategies for wealthy investors is for informational purposes only. Please do not construe the educational information as personal advice. We do not provide legal, tax, or financial advice. Please consult your attorney, accountant, and advisor for relevant strategies applicable to your portfolio.

Leave A Comment