Wealthy investors, particularly executives with concentrated positions in a specific stock (or stocks), who are always worried about how to protect the position/wealth against market volatility may want to consider a collar options strategy.

Imagine, if an entrepreneur sold a startup to a publicly listed company and had received the acquirer’s stock as consideration. Now, the entrepreneur’s net worth – sometimes more than 90% in startup cases – is tied up in the company which acquired the startup.

Alternatively, consider the case of an executive who worked for many years in a company and has accumulated restricted stock, options – both vested and unvested, as well as company stock. Also, many executives tend to accumulate positions in stocks in related sectors as their familiarity typically trumps the wisdom of diversification.

While progressive liquidation of the position and strategic diversification are the right long-term approaches, in the short-term, investors intending to protect against the downside risk in concentrated stock positions can utilize a derivatives strategy – a Collar option. It is sometimes called a hedge wrapper and as the name suggests it is a hedging strategy against downside on a particular stock position.

What is a Collar Option Strategy?

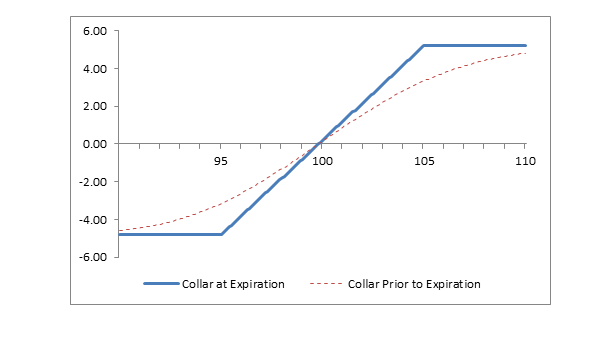

A collar option strategy is a defensive derivative strategy which involves buying out-of-the-money protective puts and simultaneously selling out of the money calls on an existing position to protect the downside risk. The goal is to achieve breakeven in the transaction as the primary intent from the collar option strategy is risk protection not necessarily profit from the specific option transaction. In general, the approach involves buying and selling an equal number of contracts with similar expiration month. The number of Collar option contracts depend on what fraction of the existing holding that investor intends to protect.

While breakeven is the desired outcome, in times of a bearish outlook and significant volatility, buying the put option may cost more than the receipts from selling the call options.

How does a Collar Options Strategy work?

Let us assume Jill Owens built a startup from scratch and sold it to listed company ABCD Inc. As a part of her stake in the startup, Jill received $200,000 shares of ABCD Inc. stock which are presently trading at $100, making the value of her holdings in ABCD stock $20 million. Jill has no other significant savings or investments as her life and time was spent in conceptualizing and building the startup from scratch. The position in ABCD Inc. stock is about 95% of her family’s net worth.

Now, one can argue that Jill should have a pre-planned stock dilution and she should diversify into other asset classes and investments. And all that will be true. However, Jill feels the optics of liquidating her position would not look good (which may not be a good reason) and also she feels her little startup could reshape the future of ABCD Inc and she wants to reap the rewards of that hard work on the anvil.

So, whatever the rationale and justification of holding the concentrated position, Jill also wants to protect the downside risk of ABCD Inc. stock falling precipitously. Instead of trying to preserve entire holding value of $20 million, Jill and her advisor have zeroed in on protecting $10 million and let the rest ride.

The goal for Jill is to buy protection for the stock holding while minimizing the out of pocket outflows. Hence, Jill’s advisor suggested a collar as a potential derivative strategy.

So, the strategy involves buying 100 put contracts on ABCD stock that are out of the money and then selling 100 out of the money call contracts with the same calendar expiration. The primary goal in this scenario is striving to set up a zero-cost collar to minimize out of the pocket premium expense.

Let’s assume that the ABCD Inc. common shares are listed at $100. Jill’s advisory team purchased put options at a price of $45 and then sold call options at $57. Let’s assume when netted out, the out of pocket premium for Jill is $1,000. So, essentially Jill is buying the option of selling her stock at $45 irrespective of the fall in price before the put option expires. And she MUST sell the stock at $57, during the option holding period, regardless of how much the stock price may rise. Thus, while there is a floor with the put option, there is also a ceiling because of the Call options that Jill sold to offset the cost of buying the put.

As long as the cost is reasonable to give Jill peace of mind that her half her net worth is safe, the strategy may be worth pursuing.

Of course, there are variations of the strategy that one can follow where instead of the options on the stock, one can use index options.

Things to be aware of while executing a collar option strategy on a concentrated stock:

- The collar option is somewhat temporary and needs to be renewed when the options expire unexercised.

- While a collar option strategy protects the downside, there is a cap to the upside.

- Depending on the market and stock specific outlook, and the volatility, zero cost collars may not be viable thus resulting in net cash outflow.

- The collar option strategy does not afford diversification and hence not a viable long-term strategy. The ideal scenario is periodic and planned dilution of concentrated positions.

- One may also pursue a strategy of pooled investment vehicle of concentrated positions from various investors in a diverse range of stocks. These “Exchange Funds” or “Swap Funds” are a way for a group to come together to diversify without actually selling the holding and incur an immediate taxable event. We will address this topic in a separate article.

How to calculate the break-even, maximum profit, and maximum risk on a collar options strategy?

Calculating the maximum possible profit:

Maximum possible profit on a Collar equals the strike price of short call minus the purchase price of the underlying security and add the net premium received and of course minus transaction costs.

Calculating the maximum loss potential:

Maximum loss possible equals the purchase price of underlying security minus the strike price of long put minus the net premium received plus the transaction costs.

Calculating the breakeven point:

The breakeven point equals the purchase price of underlying security plus the net premium paid

Leave A Comment